DeFi + RWA: How Tokenization Could Revolutionize DeFi and the Future of the Economy

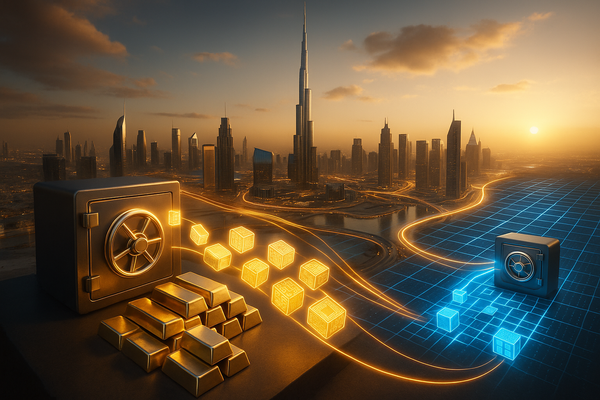

DeFi and RWA tokenization are merging to redefine global blockchain economy. As real-world assets move on-chain, the next wave of innovation is unfolding beyond and growing crypto communities could be one of the biggest beneficiaries.

Over the years, the cryptocurrency industry has evolved far beyond trading coins and tokens. From Bitcoin’s early promise of financial freedom to Ethereum’s smart contract revolution, the crypto landscape continues to expand into new frontiers. Now, as 2025 unfolds, a new wave of innovation is merging two powerful ideas, Decentralized Finance (DeFi) and tokenization of real-world assets (RWAs). Together, they are quietly reshaping how global finance works, and their impact could soon reach emerging markets like Crypto Pakistan, where blockchain adoption is steadily gaining ground.

Bitcoin started as a digital alternative to money, decentralized, borderless, and immune to government manipulation. It gave people the ability to store and transfer value without intermediaries. But the introduction of smart contracts on Ethereum opened the next chapter: Decentralized Finance (DeFi).

DeFi allowed anyone to lend, borrow, trade, and earn yield directly on the blockchain. It removed the traditional middlemen, banks, brokers, and institutions, replacing them with code and transparency. For a time, yield farming and liquidity pools drove massive innovation, though they also revealed weaknesses such as volatility, scams, and unsustainable token incentives.

By 2025, the DeFi landscape will have matured. The focus has shifted from speculative returns to real, sustainable yield, and that’s where tokenization enters the story.

What Tokenization Really Means

In simple terms, tokenization is the process of converting ownership of a real-world asset, such as real estate, government bonds, commodities, or even fine art, into a digital token on the blockchain. These tokens can then be traded, divided into smaller units, and integrated into DeFi ecosystems.

The benefits are enormous:

- Liquidity for illiquid assets: Investors can sell fractions of assets that were previously hard to trade.

- 24/7 global markets: Unlike traditional stock exchanges, tokenized assets can trade anytime, anywhere.

- Lower costs and faster settlement: Blockchain-based transfers eliminate paperwork and middlemen.

- Transparency and compliance: Every transaction can be verified on-chain.

For example, instead of needing $100,000 to invest in a property, a user could buy a $100 token representing a share of it. These digital tokens could even be used as collateral in a DeFi lending protocol. That’s the power of merging real-world assets with decentralized finance.

Why 2025 Is the Year of DeFi + Tokenization

This year, the concept of tokenization has shifted from theory to reality. Major global companies and institutions are now experimenting with tokenized stocks, bonds, and money market funds. Crypto exchanges and DeFi protocols are building infrastructure to support real-world assets as collateral.

In the past, DeFi was primarily built around crypto-native tokens. Now, it’s expanding to include tokenized treasury bills, corporate debt, and private credit, making DeFi more stable and appealing to institutional investors. The integration of real assets gives DeFi a solid foundation, one that’s tied to the global economy rather than speculative hype.

Tokenized assets also create a bridge between traditional finance (TradFi) and decentralized finance. This hybrid model is often called “DeFi 2.0”, where regulated assets meet blockchain efficiency. It’s no longer about replacing banks but building a more transparent and programmable financial layer above them.

How It Works in Practice

Here’s how the system typically operates:

- Asset Creation: A real-world asset, such as a government bond, is locked or custodied by a regulated entity.

- Token Minting: A blockchain token representing that asset is issued, 1 token equals 1 share of ownership.

- DeFi Integration: The token can be used in decentralized applications, as collateral, for trading, or in yield pools.

- Redemption: When a user wants to exit, they can redeem the token for the underlying asset or its cash value.

This process ensures that while assets exist in the real world, their value and ownership can move freely across blockchain networks. It’s a massive leap in how financial markets operate, and it’s happening faster than many realize.

Institutional Interest Is Driving the Boom

Traditional institutions are no longer ignoring DeFi. Leading fintech platforms, blockchain foundations, and exchanges are investing in tokenization infrastructure.

The numbers tell the story: over $33 billion worth of real-world assets are already represented on public blockchains, a figure that continues to grow each month. These assets include everything from tokenized U.S. Treasury bills to private credit markets. The reason is simple: tokenization offers efficiency, speed, and transparency that legacy systems can’t match.

Even established financial platforms are recognizing that the tokenized future is inevitable. The dream is a world where stocks, bonds, and commodities trade 24/7 on global blockchains, accessible to anyone, not just accredited investors.

Pakistan’s Place in the Tokenization Era

While most of the tokenization movement is happening in the U.S., Europe, and the UAE, countries like Pakistan have a huge opportunity to benefit from this transformation. The local economy faces challenges such as limited access to credit, illiquid real estate markets, and slow cross-border payments. Tokenization could solve many of these issues.

Imagine if Pakistani startups could tokenize equity and raise funds directly from investors worldwide, or if real estate projects could sell fractional ownership tokens to the public. Even remittance flows, a vital part of the economy, could move through DeFi-based channels with lower fees and faster settlement.

As Crypto in Pakistan continues to evolve, local innovators and regulators should look closely at the global trend toward asset tokenization. By integrating regulated frameworks, Pakistan could leapfrog traditional banking limitations and create new opportunities for both investors and entrepreneurs.

Challenges on the Road Ahead

Of course, this transformation won’t come without challenges. DeFi still faces issues of smart contract security, regulatory uncertainty, and liquidity fragmentation. Tokenization adds its own complexities, especially around legal ownership, asset custody, and compliance across different jurisdictions.

For tokenized assets to truly succeed, trust between the digital and physical worlds must be established. This means better auditing standards, real-world verification systems, and consistent global regulation. Without these safeguards, tokenized finance risks repeating the same pitfalls that traditional finance struggled to fix.

The Future: Real Yield from Real Assets

The future of crypto isn’t just speculative trading; it’s about integrating blockchain technology into the real economy. By combining DeFi’s open financial architecture with tokenized assets, the industry can deliver genuine value to users, investors, and institutions alike.

This evolution marks a major step forward from the early “DeFi Summer” era. Instead of chasing temporary yield, investors are now earning stable returns from tokenized bonds, real estate, and other income-generating assets. In other words, DeFi is maturing, from risk to reliability, from hype to utility.

DeFi began as an experiment in open finance, and tokenization is turning that experiment into a sustainable financial system. Together, they are unlocking access, efficiency, and global liquidity at a scale never seen before.

For regions like Pakistan, where financial inclusion and digital adoption are rising rapidly, the DeFi + tokenization wave could open doors to new investment opportunities and innovative business models.

Bitcoin laid the foundation for financial freedom; tokenization may be the bridge that connects it to the real economy. The next phase of crypto isn’t just about digital currencies, it’s about digitizing everything. And in this new chapter, countries that move early, including Pakistan, could find themselves at the forefront of the global financial revolution.