Pakistan and Bitcoin Reserves: Can the Country Take the Lead in South Asia?

Bitcoin in Pakistan is gaining momentum as policymakers debate whether the country should build strategic Bitcoin reserves. Could Pakistan become the first nation in South Asia to adopt Bitcoin as part of its national reserves?

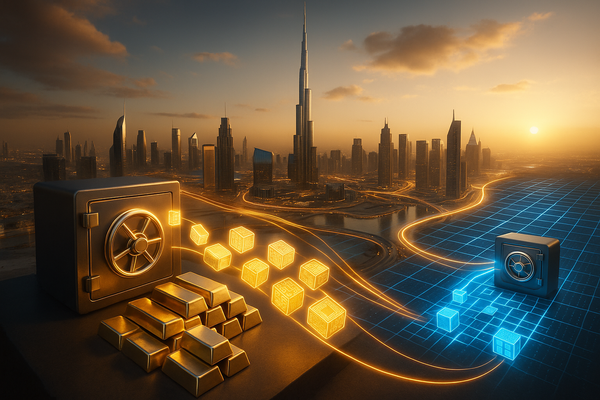

For decades, nations have built strategic reserves of gold, oil, and foreign currencies to secure their economies against crises. But in today’s digital era, the conversation is shifting.

The question now arises: Could Pakistan be the first South Asian nation to build strategic Bitcoin reserves, and take the lead in the region’s digital economy?

Why Strategic Bitcoin Reserves Matter

Bitcoin has often been called “digital gold.” Unlike fiat money, it cannot be printed endlessly by central banks, and unlike gold, it is highly portable and verifiable. For countries with fragile economies, holding Bitcoin can provide:

- A hedge against inflation – Bitcoin’s fixed supply of 21 million coins makes it resistant to devaluation.

- Diversification of reserves – Moving beyond gold and U.S. dollars.

- Geopolitical independence – Bitcoin cannot be frozen by external powers or international sanctions.

Already, El Salvador has added Bitcoin to its national reserves, and discussions within nations suggest other governments may follow.

Pakistan’s Economic Context

Pakistan faces recurring challenges with its foreign reserves, often dependent on IMF loans, remittances, and external debt restructuring. Inflationary pressures and a weakening rupee have left the country vulnerable.

Traditionally, Pakistan has relied on gold and the U.S. dollar to secure its reserves. But these assets are not fully under its control, and dollar reserves are influenced by U.S. monetary policy, and gold is both illiquid and hard to mobilize in times of crisis.

In this context, a small allocation to Bitcoin could give Pakistan a new layer of economic resilience.

Regional Competition in South Asia

South Asia is home to hundreds of millions of young, tech-savvy citizens, many already active in the crypto space. But governments remain cautious:

- India has high crypto adoption rates but continues to enforce strict regulations.

- Bangladesh has banned crypto trading.

- Sri Lanka and Nepal are still in the early stages of digital finance.

If Pakistan takes the lead in building Bitcoin reserves, it could outpace its neighbors in adopting digital assets at a national level. This would not only strengthen Pakistan’s economy but also position it as a regional hub for crypto innovation.

Challenges Ahead

Of course, there are hurdles. Pakistan’s regulators, including the Pakistan Virtual Assets Regulatory Authority (PVARA), are still drafting the framework for crypto exchanges and mining operations. The Finance Ministry has also indicated that any major move must be aligned with the IMF, World Bank, and FATF requirements.

Moreover, Bitcoin’s volatility is a concern. A sudden price drop could reduce the value of reserves in the short term. Policymakers would need to balance risk management with long-term vision.

The Way Forward

Experts suggest a cautious approach:

- Start with 1–3% of reserves allocated to Bitcoin, rather than going all-in.

- Encourage Bitcoin mining in Pakistan using renewable energy (hydro, wind, and solar), turning energy into digital reserves.

- Integrate Bitcoin into remittance flows, where Pakistan receives over $30 billion annually, saving billions in transfer fees.

This phased strategy would allow Pakistan to test the waters while avoiding excessive risk.

Building Bitcoin reserves may sound radical today, but so did holding gold a century ago. For Pakistan, it could be a way to reduce dependency on external powers, stabilize reserves, and lead South Asia in financial innovation.

The choice is clear: Pakistan can either wait and follow or take bold steps and lead South Asia into the Bitcoin era.