Ripple Partners with Bahrain Fintech Bay to Roll Out RLUSD Stablecoin

Ripple is building strong roots in the Gulf region, from powering Dubai’s real estate tokenization to expanding in Bahrain’s fintech ecosystem with real-world blockchain utility.

Ripple, one of the most established blockchain companies in the world and the issuer of the XRP cryptocurrency, is making consistent moves across the Gulf, a region that is rapidly becoming the global center for regulated digital asset innovation.

What started as a single partnership in Dubai has now evolved into a regional expansion strategy that includes Bahrain, the UAE, and beyond. Ripple’s focus is clear: align with governments, comply with regulations, and build the financial infrastructure for tokenization, cross-border payments, and stablecoin innovation.

Ripple’s Early Entry into the UAE

Ripple’s entry began with the UAE, a country that has become a sandbox for blockchain regulation and digital finance. Over the past few years, the UAE government has made major strides through entities like the Dubai Virtual Assets Regulatory Authority (VARA) and the Abu Dhabi Global Market (ADGM) to provide legal clarity for digital asset businesses.

Recognizing this opportunity early, Ripple positioned itself in the region not through hype but through institutional partnerships and real-world use cases. One of the most notable moves came through its collaboration with Ctrl Alt, a UAE-based digital asset platform focused on real estate tokenization.

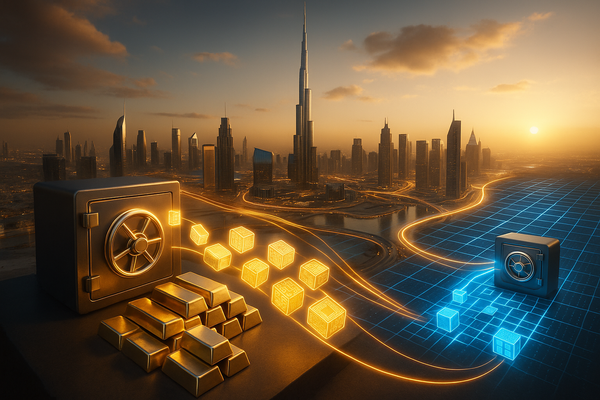

In Dubai, Ripple partnered with Ctrl Alt to bring institutional-grade custody for real estate tokenization projects, an initiative aligned with the vision of the Dubai Land Department (DLD) to modernize property ownership and registration using blockchain.

The project uses the XRP Ledger (XRPL) to store tokenized property deeds, making them traceable, transparent, and secure. This represents one of the first large-scale integrations of blockchain in Dubai’s real estate sector, a sector worth hundreds of billions of dollars and a key pillar of the UAE’s economy.

By leveraging the XRPL, Ripple provided the technological foundation that enables property developers, brokers, and investors to tokenize high-value assets, allowing fractional ownership, faster settlement times, and global investor participation, all while remaining compliant with Dubai’s regulatory framework.

This step established Ripple as a trusted infrastructure provider for blockchain projects in the UAE, rather than just a crypto payment company.

Expanding to Bahrain: The Next Strategic Move

Ripple’s latest development further strengthens its Middle East presence. In 2025, Ripple announced a strategic partnership with Bahrain FinTech Bay (BFB), one of the leading fintech innovation hubs in the Gulf region.

Founded in 2018, Bahrain FinTech Bay operates as a public-private initiative involving the Bahrain Economic Development Board (EDB) and the FinTech Consortium, with close collaboration with the Central Bank of Bahrain (CBB). It serves as a center for developing and testing cutting-edge financial technologies that support the country’s digital transformation agenda.

Through this partnership, Ripple and BFB will collaborate on fintech pilot programs, regulatory testing, and digital asset initiatives across multiple areas, including:

Cross-border payments, simplifying international remittances using blockchain.

Stablecoins, exploring the introduction of Ripple’s upcoming Ripple USD (RLUSD) stablecoin.

Tokenization, experimenting with real-world asset integration in financial systems.

According to Reece Merrick, Ripple’s Managing Director for the Middle East, the company plans to make its digital asset custody solution and RLUSD stablecoin available to Bahraini financial institutions as part of the collaboration. This expansion demonstrates Ripple’s commitment to building infrastructure for a compliant, scalable, and innovative digital asset ecosystem across the Gulf.

Ripple’s success in the Middle East is not accidental, it’s built on a clear understanding of where the real regulated growth in blockchain is happening.

While many crypto projects focus on hype-driven adoption, Ripple has taken a compliance-first approach, aligning itself with governments and central banks to build long-term infrastructure. This strategy has proven successful in a region that prioritizes regulatory clarity and institutional adoption over speculative projects.

The company’s partnerships with entities like Ctrl Alt, Dubai Land Department, and Bahrain FinTech Bay show how Ripple is connecting the dots between blockchain technology and real-world utility, from real estate tokenization to cross-border financial networks.

By anchoring itself in countries like the UAE and Bahrain, Ripple is helping shape the regulated blockchain ecosystem of the Middle East, an ecosystem that may soon become a global benchmark for digital finance.

Ripple’s original mission was to revolutionize cross-border payments using blockchain, offering a faster and cheaper alternative to traditional systems like SWIFT. However, the company’s vision has evolved.

Now, Ripple is positioning itself as a digital asset infrastructure provider, supporting tokenization, stablecoins, and decentralized finance (DeFi) innovations that extend far beyond remittances.

Its RLUSD stablecoin aims to provide a regulated and enterprise-grade solution for global payments and on-chain finance, potentially integrating seamlessly into its XRP Ledger ecosystem. Combined with its growing network of partners in the Middle East, Ripple is becoming one of the few blockchain firms that bridge traditional finance (TradFi) with regulated digital assets.

The Middle East is rapidly emerging as the epicenter of digital asset regulation. Both the UAE and Bahrain have established themselves as forward-thinking jurisdictions offering clear frameworks for crypto businesses, while Saudi Arabia and Qatar are closely monitoring the progress to shape their own policies.

By embedding itself deeply within these ecosystems, Ripple has secured a first-mover advantage that could pay massive dividends in the coming years, especially as the global financial system shifts toward tokenized assets and blockchain-based settlements.

Ripple’s expansion in the Middle East marks a pivotal moment in its global strategy. From supporting real estate tokenization in Dubai to driving fintech innovation in Bahrain, Ripple has positioned itself as a central player in shaping the region’s blockchain infrastructure.

Rather than chasing speculation, Ripple is building what truly matters, regulated, compliant, and real-world blockchain solutions.

The company’s steady progress in the Middle East is a reminder that the next wave of blockchain growth won’t come from hype, but from utility, partnerships, and trust.