What is a Crypto Exchange? A Beginner's Guide for Pakistan (2026)

This guide is designed to demystify what a crypto exchange is, explain how these platforms operate, and provide a clear framework for choosing a secure and reliable option tailored for users in Pakistan.

Navigating the world of digital assets can be daunting, especially for those new to the space. The first and most fundamental tool you will encounter is the cryptocurrency exchange.

What is a Cryptocurrency Exchange

In the simplest terms, a cryptocurrency exchange is a digital marketplace where you can buy, sell, and trade cryptocurrencies. Think of it as a stock exchange, like the Pakistan Stock Exchange (PSX), but instead of trading company shares, you are trading digital assets such as Bitcoin (BTC), Ethereum (ETH), and thousands of other altcoins. The primary purpose of an exchange is to facilitate these transactions by connecting buyers with sellers in a secure and efficient environment.

Key Functions of a Crypto Exchange

- Matching Orders: The core function of an exchange is to operate an "order book." When you place an order to buy Bitcoin at a certain price, the exchange finds a corresponding sell order from another user and executes the trade.

- Providing Liquidity: A major exchange has thousands of active users, ensuring there is enough trading activity (liquidity) so you can buy or sell your assets quickly at a stable price without significant delays.

- Custody: Many exchanges offer custodial services, meaning they hold and secure your cryptocurrency on your behalf in their digital wallets. While convenient, this comes with inherent risks, as you are entrusting a third party with your assets.

- Fiat-to-Crypto Gateway: A critical function for beginners is the ability to convert traditional currency, like the Pakistani Rupee (PKR) or US Dollar (USD), into cryptocurrency. Exchanges act as this essential on-ramp to the digital asset economy.

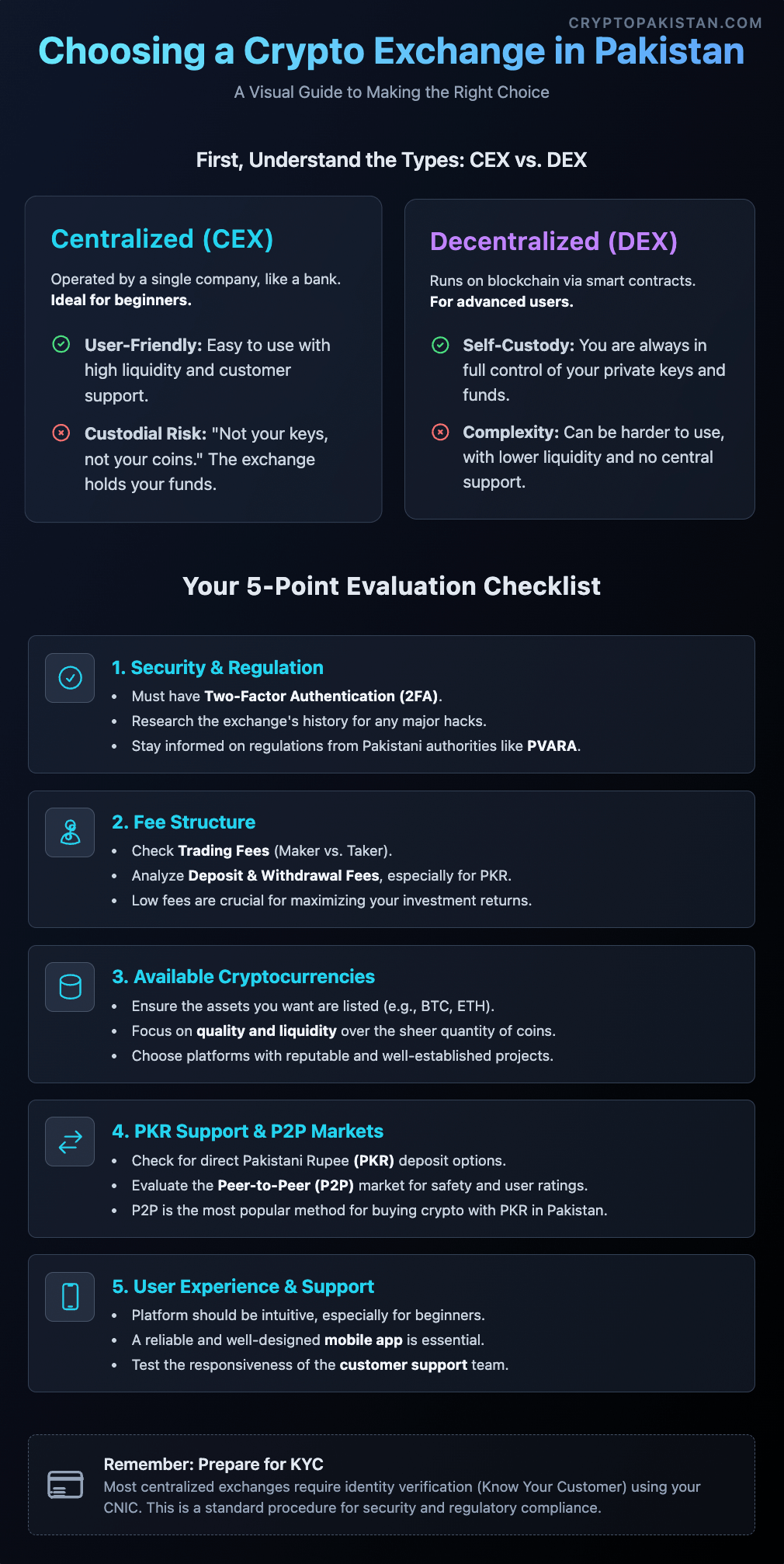

Types of Crypto Exchanges: Centralized vs. Decentralized

Not all exchanges are created equal. The most significant distinction lies in their underlying structure and who ultimately controls the funds and data on the platform. Understanding the difference between centralized and decentralized models is fundamental to managing your risk as an investor.

Centralized Exchanges (CEX)

A centralized exchange is a platform operated by a single, private company. These are the most common and widely used exchanges, with familiar names like Binance and HTX. They function much like traditional financial institutions.

- Pros: They are typically very user-friendly, offer high trading volumes (good liquidity), and provide customer support services. This makes them the ideal starting point for beginners.

- Cons: The primary drawback is that you do not control the private keys to your crypto; the exchange does. This is often summarized by the phrase "not your keys, not your coins." They also require mandatory identity verification (KYC).

Decentralized Exchanges (DEX)

A decentralized exchange is an automated platform that runs on a blockchain via smart contracts. It operates without a central authority or intermediary. Examples include platforms like Uniswap and PancakeSwap.

- Pros: The main advantage is self-custody—you are always in complete control of your funds and private keys. They also offer greater privacy as many do not require a formal KYC process.

- Cons: DEXs can be more complex to use, often have lower liquidity for certain asset pairs, and lack a central customer support system if something goes wrong. They are better suited for more advanced users.

How to Choose a Crypto Exchange in Pakistan: A 5-Point Checklist

Selecting the right exchange is one of the most critical security decisions you will make in your crypto journey. Before depositing any funds, carefully evaluate potential platforms based on the following key factors relevant to the Pakistani market.

1. Security and Regulation

Security should be your top priority. Look for platforms that offer robust security features like mandatory two-factor authentication (2FA). Research the exchange's history to see if it has suffered any major hacks or security breaches. It is also vital to stay informed on Pakistan's evolving regulatory landscape, including any directives from bodies like the Pakistan Virtual Assets Regulatory Authority (PVARA).

2. Fees Structure

Exchanges make money through fees, which can significantly affect your investment returns if you are not careful. Pay close attention to trading fees (often split into "maker" and "taker" fees), as well as the fees for depositing and withdrawing funds, especially when dealing with PKR.

3. Available Cryptocurrencies

Ensure the exchange lists the specific cryptocurrencies you are interested in buying or trading. While a large selection of coins can be attractive, it is more important to choose a platform that lists reputable and well-established projects. Quality and liquidity matter more than sheer quantity.

4. PKR Support and P2P Markets

For users in Pakistan, the ability to transact with the local currency is a major convenience. Check if the exchange allows direct deposits of Pakistani Rupees (PKR). If not, evaluate its Peer-to-Peer (P2P) marketplace. P2P platforms, which connect buyers and sellers directly, are a very popular and effective method for buying crypto with PKR in Pakistan, but you must assess their safety features and user ratings.

5. User Experience and Support

The platform should be intuitive and easy to navigate, especially for a beginner. A reliable and well-designed mobile application is also essential for managing your assets on the go. Furthermore, check the availability and responsiveness of the customer support team, as you may need their assistance.

A Note on KYC (Know Your Customer)

Be prepared to complete a "Know Your Customer" (KYC) verification process. Most centralized exchanges require you to verify your identity by submitting official documents, such as your Computerized National Identity Card (CNIC). This is a standard procedure for compliance with global Anti-Money Laundering (AML) regulations and is designed to prevent illicit activities.

Frequently Asked Questions

What is the difference between a crypto exchange and a crypto wallet?

A crypto exchange is a marketplace for buying and selling, while a crypto wallet is a tool for securely storing your digital assets. While exchanges provide wallets, it is widely recommended to move your crypto to a private, non-custodial wallet for long-term storage to maintain full control.

Is it legal to use crypto exchanges in Pakistan?

The regulatory environment for cryptocurrency in Pakistan is still developing. While there is no outright ban on individuals owning crypto, the legal framework is not yet fully established. Users should stay updated on official announcements from regulatory bodies like the SBP and PVARA.

Do I have to complete KYC to buy Bitcoin in Pakistan?

On most major centralized exchanges, yes, you will need to complete KYC. However, some P2P platforms and decentralized exchanges may not require it, though this can come with different risks.

Can I buy crypto with Pakistani Rupees (PKR) directly on an exchange?

Some exchanges offer direct PKR deposits, but the most common method is using the P2P market available on major platforms like Binance, where you can buy crypto directly from other users via local bank transfers or payment services.

Which is the biggest and most used crypto exchange in Pakistan?

Binance is widely regarded as the largest and most popular cryptocurrency exchange globally and among users in Pakistan, primarily due to its extensive features and liquid P2P marketplace for PKR.

What happens to my money if a crypto exchange gets hacked?

If a centralized exchange is hacked, your funds could be at risk of being lost permanently. While some exchanges have insurance funds (like Binance's SAFU), recovery is not guaranteed. This is why self-custody in a private wallet is highly recommended for significant holdings.

Choosing the right crypto exchange is your first step toward participating in the digital asset economy. By prioritizing security, understanding the fee structures, and selecting a platform that fits your needs, you can build a solid foundation for your investment journey. Stay informed, remain cautious, and never invest more than you are willing to lose. To stay ahead of the curve with authoritative reporting on the crypto landscape in Pakistan, Get the latest, unbiased crypto news for Pakistan.