Why Nations Are Quietly Building Strategic Bitcoin Reserves

From gold to Bitcoin, governments are quietly building crypto reserves through seizures, mining, and policy experiments. Here’s what this global shift means for Pakistan’s future in the digital economy.

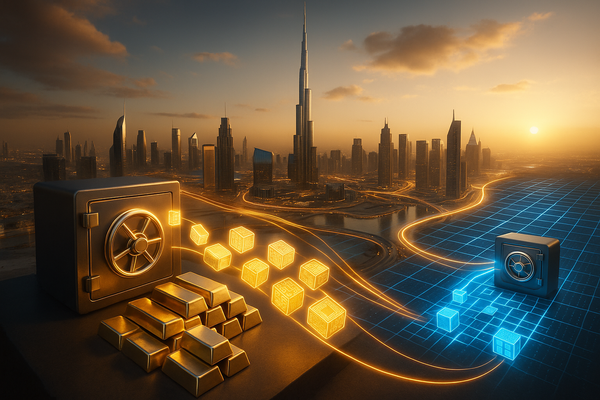

For centuries, gold has been the ultimate strategic reserve. Nations accumulate it to back their currencies and stabilize economies in times of crisis. But now, something very different is happening, governments are beginning to treat Bitcoin as a reserve asset, alongside gold and foreign currencies.

This shift isn’t always obvious. No government is loudly declaring that we’re buying Bitcoin. Instead, many are quietly accumulating BTC through seizures, state-backed mining, or small-scale policies. Step by step, Bitcoin is finding its way into national treasuries.

Who’s Holding Bitcoin Today?

United States

The U.S. has become one of the largest holders of Bitcoin, not by buying it, but by seizing it from criminal cases like Silk Road and darknet markets. In 2025, the Trump administration even announced a Strategic Crypto Reserve, meaning seized Bitcoin will now be held instead of sold off at auctions. Officials say the government isn’t planning to buy Bitcoin directly, but this move alone signals that BTC is being treated as a long-term national asset.

El Salvador

El Salvador is still the only country actively buying Bitcoin as part of government policy. Since making Bitcoin legal tender in 2021, the country has accumulated around 6,000 BTC, held in government wallets. President Bukele’s bet on Bitcoin has brought global attention, even if it remains controversial with institutions like the IMF.

Bhutan

A surprise entry on the list is Bhutan. Using its massive hydropower resources, Bhutan has been quietly mining Bitcoin since 2019. Reports suggest the country may have built up around 13,000 BTC through this strategy. For a small economy, it represents a potential worth of billions of dollars in Bhutan’s GDP.

Others

Countries like China, the UK, Germany, and Ukraine also hold Bitcoin, mostly from seizures or donations. Collectively, governments worldwide are estimated to hold over 2% of Bitcoin’s total supply.

Why Are Governments Doing This?

So why hold Bitcoin at all?

- Scarcity: Like gold, Bitcoin has a limited supply. For reserve managers worried about inflation and money printing, this makes it attractive.

- Resilience: Bitcoin can’t be frozen or confiscated easily, making it appealing for countries under sanctions.

- Liquidity: It trades 24/7 worldwide, making it a flexible asset in times of crisis.

- Energy advantage: Countries with cheap or surplus energy, like Bhutan with hydropower, or potentially Pakistan with surplus electricity. can mine Bitcoin into reserves rather than waste energy.

What’s different in 2025 compared to the Bitcoin booms of 2017 or 2021 is that governments are finally starting to normalize how they handle BTC. The U.S. no longer dumps seized Bitcoin on the market. El Salvador continues buying. Bhutan shows how energy policy and reserves can connect.

For investors and policymakers, this is a big signal: Bitcoin is no longer just a speculative asset for retail traders, it’s becoming part of sovereign balance sheets.

Why It Matters for Pakistan

This global trend should be a wake-up call for Pakistan. With 2,000 MW of surplus electricity already marked for Bitcoin mining and data centers, Pakistan has the chance to follow Bhutan’s model, turning excess power into a digital reserve asset.

At the same time, Pakistan’s government is preparing to regulate crypto exchanges under the new Pakistan Virtual Assets Regulatory Authority (PVARA). If reserves or state-backed mining are included in the framework, Pakistan could position itself as a leader in South Asia’s Bitcoin economy.

We’re not at the point where Bitcoin replaces gold in central banks, but the shift has already begun. Governments are experimenting, whether by seizures or by design, like mining and strategic reserves.

The move from gold to Bitcoin won’t happen overnight, but every year the case grows stronger. And for countries like Pakistan, this may be the moment to prepare for the era of strategic Bitcoin reserves.